Federal Reserve officials left interest rates unchanged at their June meeting on Wednesday and predicted they would cut borrowing costs just once before the end of 2024, taking a cautious approach as they try to avoid announcing a premature victory over inflation.

While the Fed was expected to leave interest rates unchanged, its predictions for how interest rates might evolve surprised many economists.

When Fed officials last released quarterly economic estimates in March, they predicted they would cut interest rates three times this year. Investors had expected them to revise that outlook somewhat this time, in light of stubborn inflation in early 2024, but the shift to a single cut was more drastic.

Jerome H. Powell, the Fed chairman, made it clear at a press conference after the meeting that officials were taking a cautious and conservative approach after months of mixed inflation data.

With price increases proving volatile and the labor market remaining resilient, policymakers believe they have the wiggle room to keep interest rates steady to ensure they fully eliminate inflation without putting the economy at too much risk. But the Fed chairman also suggested that more rate cuts could be possible depending on economic data.

“Thankfully, we have a strong economy and we have the ability to approach this question carefully – and we will approach it carefully,” Mr Powell said. He added that “we are keeping in mind the downward economic risks, if they appear”.

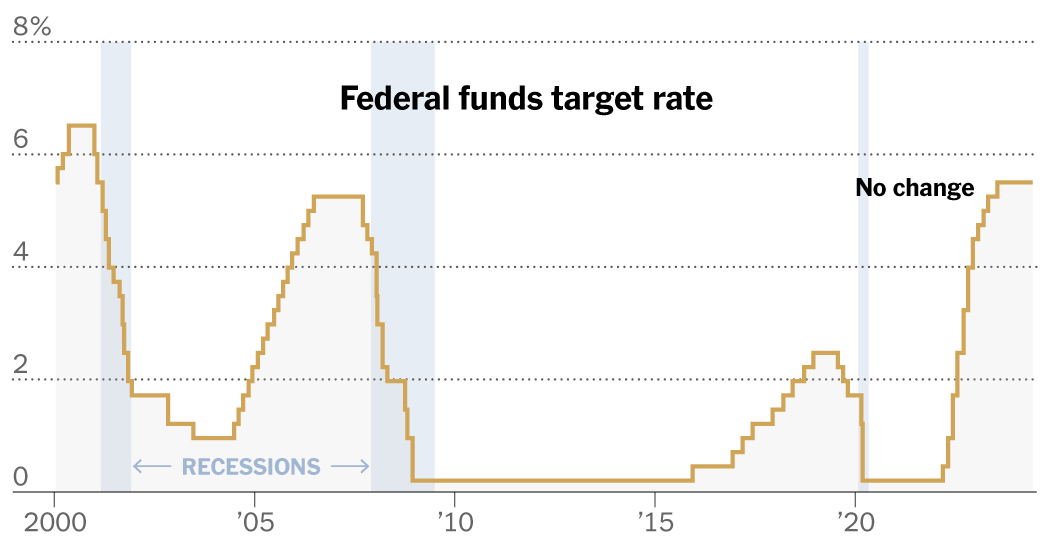

Fed officials quickly raised interest rates between early 2022 and last July to a more than two-decade high of 5.3 percent. They have held them there ever since, hoping that higher borrowing costs will slow consumer and business demand enough to return price growth to a normal pace.

Initially, the plan went well: inflation slowed steadily in 2023, so much so that Fed officials entered 2024 expecting to cut interest rates significantly. But then rising prices proved surprisingly stubborn for several months – and policymakers had to delay their plans to cut rates for fear of cutting borrowing costs too early.

The danger in cutting back prematurely is that “we could end up undoing a lot of the good we’ve done,” explained Mr. Powell on Wednesday.

Now the inflation picture is changing again. Fresh Consumer Price Index data on Wednesday suggested the pick-up in inflation in early 2024 was a pick-up in speed rather than a change in trend: Price increases cooled significantly and broadly in May.

However, the end of the year is coming for the Fed to withdraw the three rate cuts it had expected until March. And Mr. Powell made it clear that officials wanted to see more encouraging inflation reports before cutting borrowing costs.

“Readings like today’s are a step in the right direction,” he said. “But it’s just a reading. You don’t want to get too motivated by any single data point.”

If officials make just one cut before the end of the year, it will bring their policy rate to 5.1 percent. Policymakers gave no clear indication of when the rate cut might happen. They meet four more times this year: in July, September, November and December.

For American households, the Fed’s more cautious approach could mean mortgage rates, credit card rates and auto loan rates stay higher for longer. But Mr. Powell stressed that inflation, too, is painful for families and that the Fed’s goal is to suppress rapid price growth.

For President Biden, a longer period of high interest rates could portend a less buoyant economy heading into the November election. The White House avoids talking about Fed policy because the central bank sets interest rates independently so officials can make challenging decisions without bowing to short-term political pressure. But some Democrats in Congress are calling loudly for rate cuts, and current presidents generally favor lower interest rates.

Mr. Biden has come close to commenting on Fed policy at times, but has avoided directly pressuring the Fed.

On the other hand, whichever presidential candidate wins could benefit from a steeper rate-cutting path next year: Although Fed officials forecast fewer cuts in 2024, they suggested they could cut interest rates four times in 2025, from three before.

The Fed’s forecasts also showed that officials expect inflation to turn out to be more stable than they previously predicted in 2024: Headline inflation could end the year at 2.6 percent, they predicted, down from 2.4 percent in their previous estimate. Mr Powell suggested the Fed’s inflation forecasts were “conservative”.

He also made it clear that the Fed’s projections were not a set plan. If inflation falls or if the labor market takes an unexpected turn toward weakness, the Fed may respond by cutting interest rates.

“We don’t think it would be appropriate to start easing policy until we are more certain that inflation is moving down,” Mr. Powell, or unless there is a “sudden deterioration” in the labor market.

For now, the economy remains resilient and the Fed only has one meeting this summer, in July. Few investors expect any movement then.

“I think this leaves rates in a higher pattern for longer,” said Blerina Uruci, chief U.S. economist at T. Rowe Price.